When to extend a lease - residential flats

The short answer to this question is that you should definitely extend your lease before the remaining lease term drops below 80 years (if funding is available - either by mortgaging or cash). This is a critical milestone for any residential lease, as it immediately becomes considerably more expensive to extend a lease after this. However, it is strongly advisable that a lease is extended years prior to this date for the reasons set out below. There is no 'best' time to extend, individual circumstances are different, but if the remaining term is between 80 - 90 years, you should be giving serious priority to extending your lease. Consider this colour scale chart illustrating the point in relation to the remaining term of years on a lease of a flat.

Why is 80 years so important to a lease?

The premium that a leaseholder pays to a freeholder for the privilege of extending the lease follows a set formula. This formula changes the moment the lease term drops below 80 years, as at that point the formula then adds marriage value to the total cost.

Part II, Para 4(2a) of the Leasehold Leasehold Reform, Housing and Urban Development Act 1993 states that "where at the relevant date the unexpired term of the tenant's existing lease exceeds eighty years, the marriage value shall be taken to be nil". Calculating this additional 'marriage value' is quite complex. However, in simple terms, it is half of the difference between the combined total capital value of the freehold and leasehold interest after the lease extension and before it. It's easier to visualise this:

Where LF(a) is the combined total of the leasehold and freehold interest (so far as it relates to the leasehold in question) AFTER the lease extension.

Where LF(b) is the combined total of the leasehold and freehold interest (so far as it relates to the leasehold in question) BEFORE the lease extension.

Example of why timing is crucial

The chart below illustrates why 80 years is so important. We have used the data of flats worth between £350,000 to £500,000 paying ground rent of £100 per annum.

Other factors on when to extend a lease

The escalating cost of a lease extension is not the only concern. Leaseholders must take into account the following:

Difficulty mortgaging

All mortgage lenders require a minimum unexpired term left on a residential lease. This varies from lender to lender, but you can find more details in the Council of Mortgage Lenders' Handbook. The standard position is that mortgage lenders require at least 85 years remaining to fully approve a mortgage offer.

Difficulty selling

Even for leaseholders that are mortgage-free, any potential buyer is severely restricted by their mortgage lender's requirements. Most buyers fund a purchase with a mortgage, resulting in fewer potential buyers if their lender cannot accept the low lease term. Anyone looking to buy without a mortgage will most definitely be advised by their solicitor of the term of the lease and its effects on the value of the property. Unfortunately, it's a common scenario where a buyer withdraws from a purchase several weeks after conveyancers are instructed due to discovering a low lease term, leaving both the buyer and seller out of pocket with abortive legal expenses.

Diminution in value

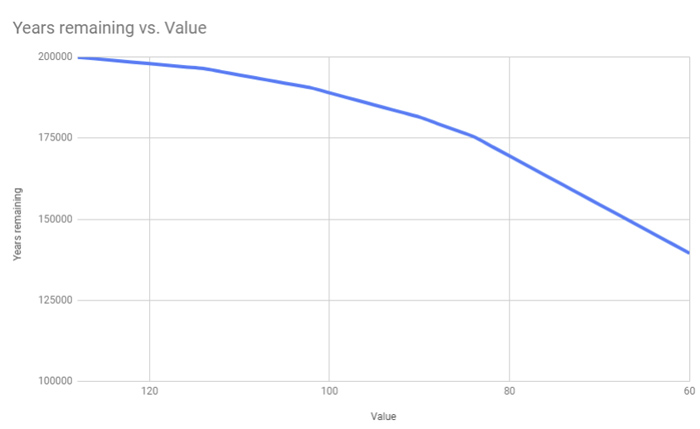

Due to the increasing premium toextend a lease year on year, the value of a lease diminishes by a value roughly equal to 120% of the increased premium. It's unlikely that a buyer would want to commence a lease extension process due to the uncertainty involved. The chart below provides an example of this reduction in value over time. As the remaining lease term drops, the rate at which the property value diminishes increases, hence posing the question to any leaseholder: why wait if funding is available?