Are Lease Extensions About To Get More Expensive?

Marriage value could potentiall be abolished in the near future under Leasehold Reform 2024, but don't expect that to result in the average leaseholder achieving a cheaper lease extension.

How could lease extensions get more expensive?

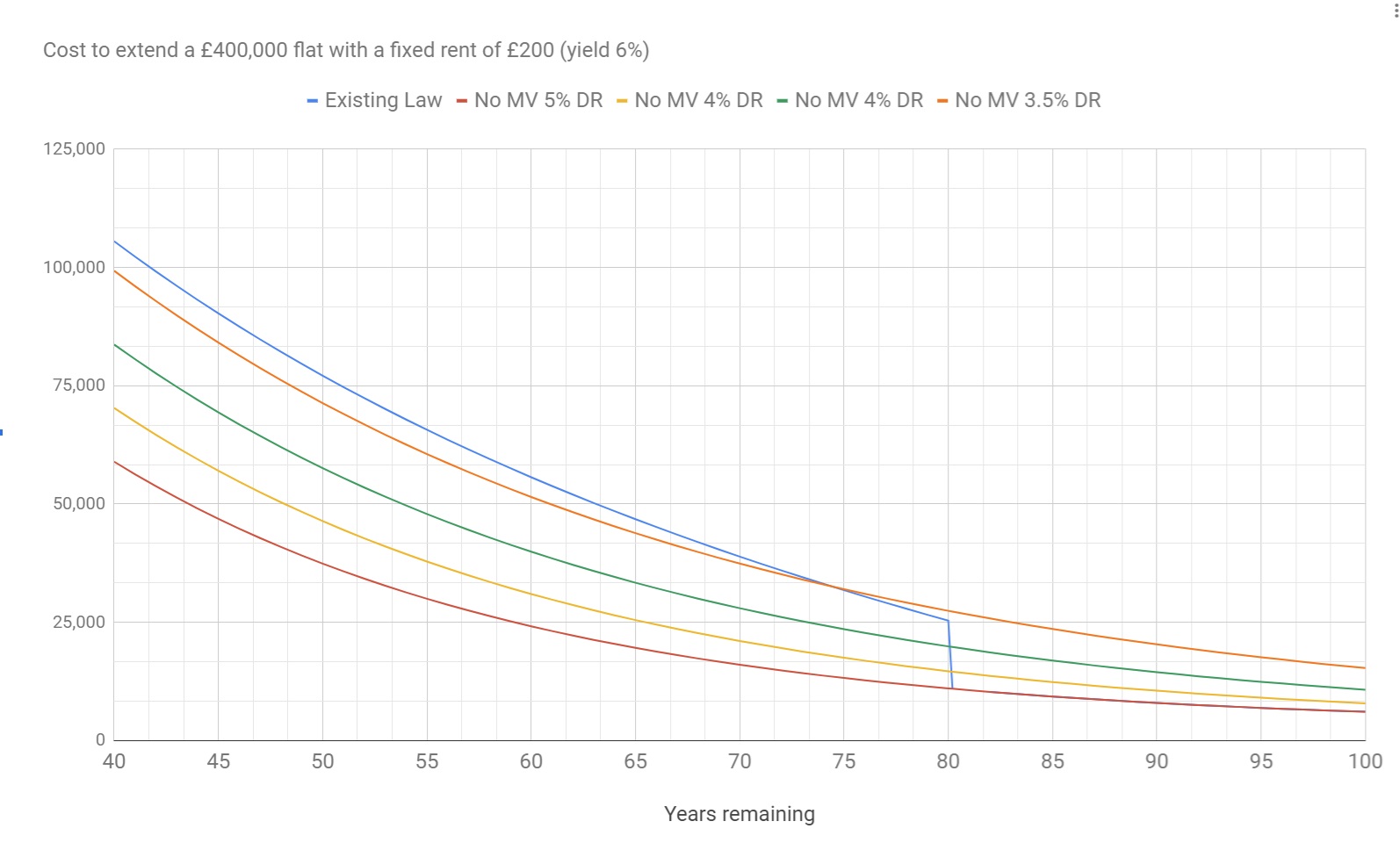

There's good evidence to suggest that marriage value will be removed, but the government knows that to get the proposals through (without infringing on the Convention of Human Rights) they will need to compensate freeholders elsewhere. With substantial active lobbying of freeholders, sources have suggested that freeholders are campaigning for a change in the deferment rate, which currently stands at 5%. A lower rate of 3.5% may not sound much on paper, but it would have a substantial impact on lease extension premiums, making it much more expensive to extend a lease for leaseholders who have more than 80 years remaining.

Who is at risk?

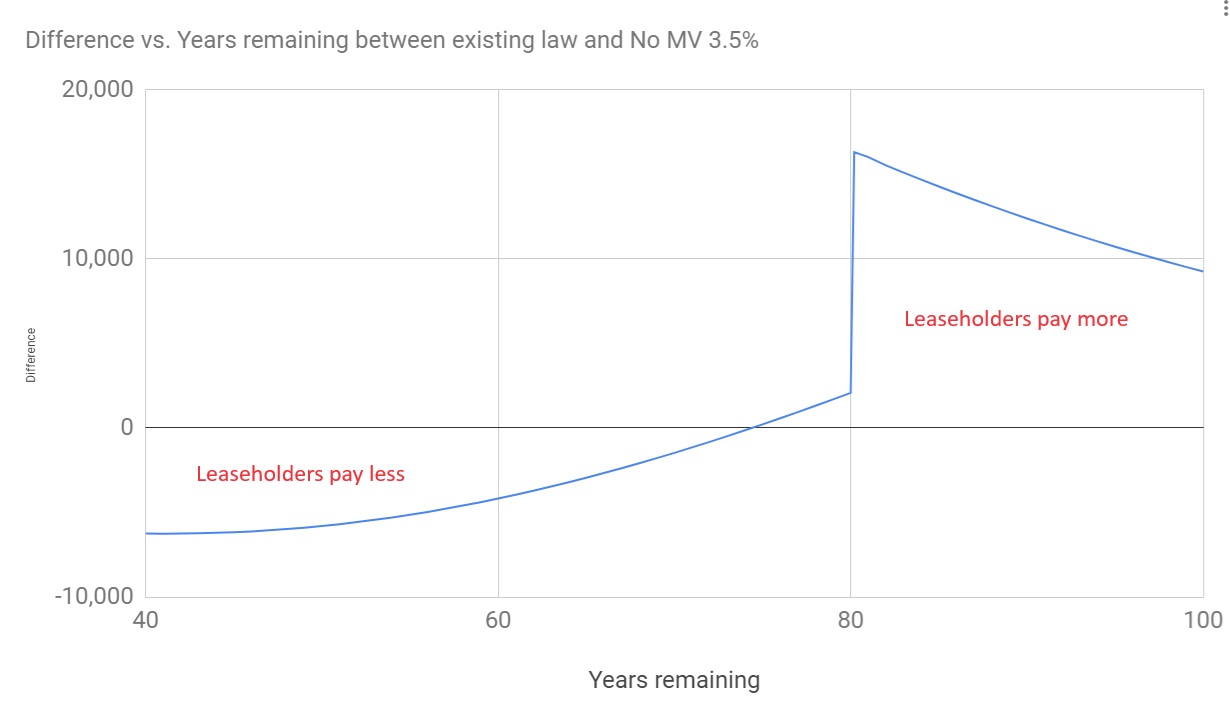

The inflection point is 74.5 years. That means anyone who has more than 74.5 years remaining will pay a higher lease extension premium if the deferment rate is cut to 3.5% despite marriage value being abolished.

How much could I save or stand to lose?

If the deferment rate is shifted to 3.5% and marriage value abolished, the premium for a leaseholder with 90 years remaining on a £400k flat / £200pa ground rent would increase 356%! From £7,506 to £19,191.

The chart below shows the savings or loss for a leaseholder with a £400,000 flat paying a fixed ground rent of £200pa. The maximum loss possible is £16,300. The best possible saving would be £6,300.

What should leaseholders do?

If you have less than 75 years remaining, then the changes described above are beneficial.

If you have more than 75 years remaining, particularly those with more than 80 years, then you should seriously consider extending your lease now, or otherwise campaign with your local MP.